Failure To Sign Tax Return Penalty 2024. Do you need to apply for. Late filing penalties apply if you owe taxes and didn't file your return or extension by april 15, 2024, or if you filed an extension but failed to file your return by.

The irs has announced the annual inflation adjustments for the year 2024. Increase in penalty for failure to file.

Yet, The Failure To Pay Penalty Persists Until The Tax Is Settled, Up To A Maximum Of 25%.

The penalty on 2023 information returns required to be filed in 2024, and 2023 payee statements required to be furnished in 2024, that are corrected later than 30 days after.

Increase In Penalty For Failure To File.

The late filing penalty is 5% of your unpaid taxes for each month your.

Washington — During The Busiest Time Of The Tax Filing Season, The Internal.

Images References :

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Fastest IRS tax penalty calculator for failure to file and pay tax, If you miss the filing deadline in 2024, or you missed filing your taxes in 2023, the irs recommends you file and pay as soon as possible. Not filing a tax return is an expensive mistake.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Fastest IRS tax penalty calculator for failure to file and pay tax, The tax preparer must sign a tax return or claim for refund if the tax preparer has primary responsibility for the overall substantive accuracy of the preparation of the tax return or. If you miss the filing deadline in 2024, or you missed filing your taxes in 2023, the irs recommends you file and pay as soon as possible.

Top 10 Tax Penalties and How to Avoid Them FlyFin, Doing so can reduce any fees and interest you'll pay on. For returns to be filed in 2024, the failure to file penalties are as follows.

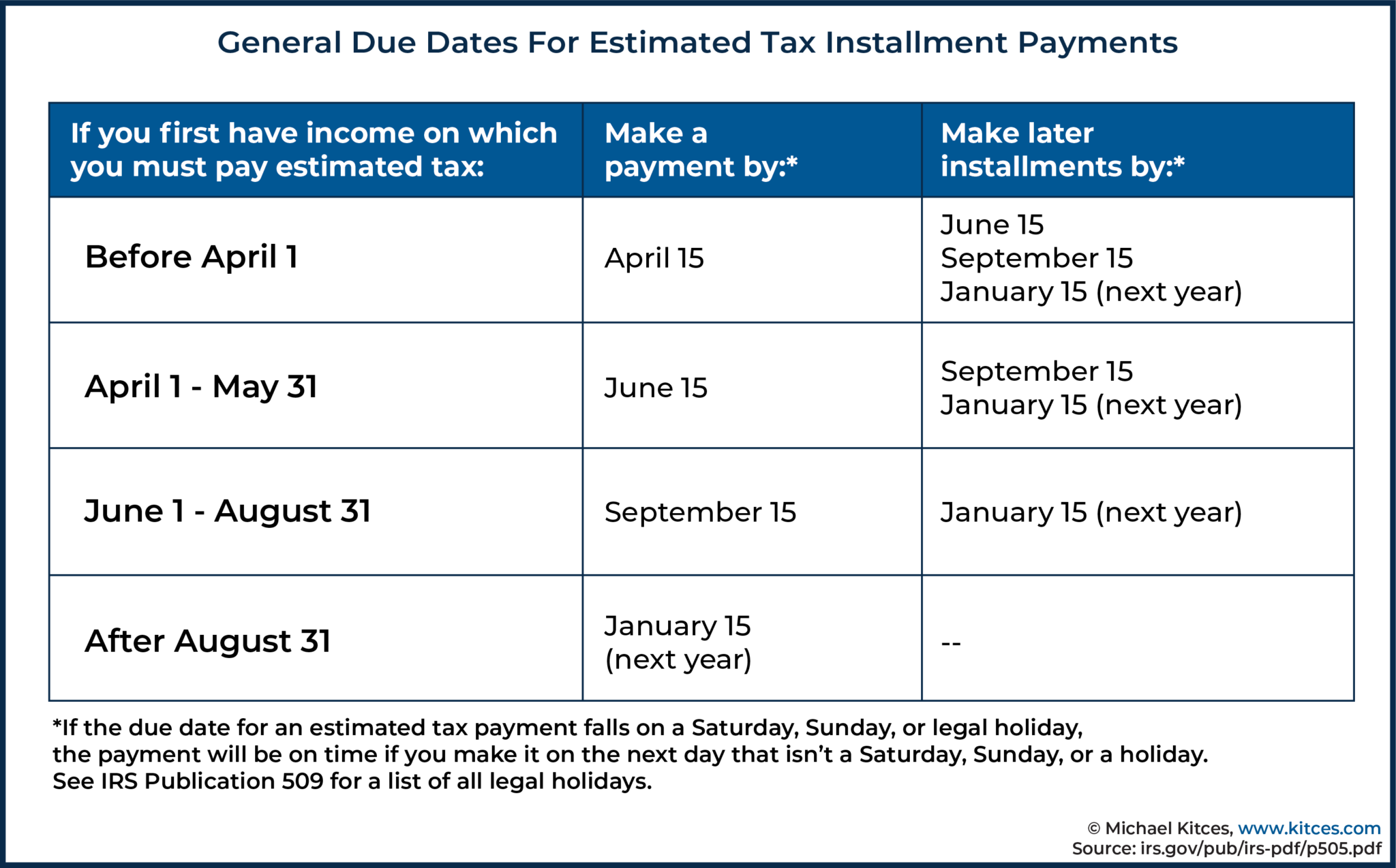

Source: www.kitces.com

Source: www.kitces.com

Reducing Estimated Tax Penalties With IRA Distributions, To avoid a failure to file penalty, make sure you file your return by the due date (or extended due date) even if you can't pay the balance due. Late filing penalties apply if you owe taxes and don't file your return or extension by april 15, 2024, or if you filed an extension but failed to file your return by.

Source: www.thequint.com

Source: www.thequint.com

Tax Return for FY 202324 Last Date and Deadline; Easy and, The late filing penalty is 5% of your unpaid taxes for each month your. That includes penalties for late returns and missed forms, as well as failure to provide forms to third parties.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Penalty for Late Tax Return Fees, Penalty Relief, & More, What to know before completing a tax return. Failure to file a tax return.

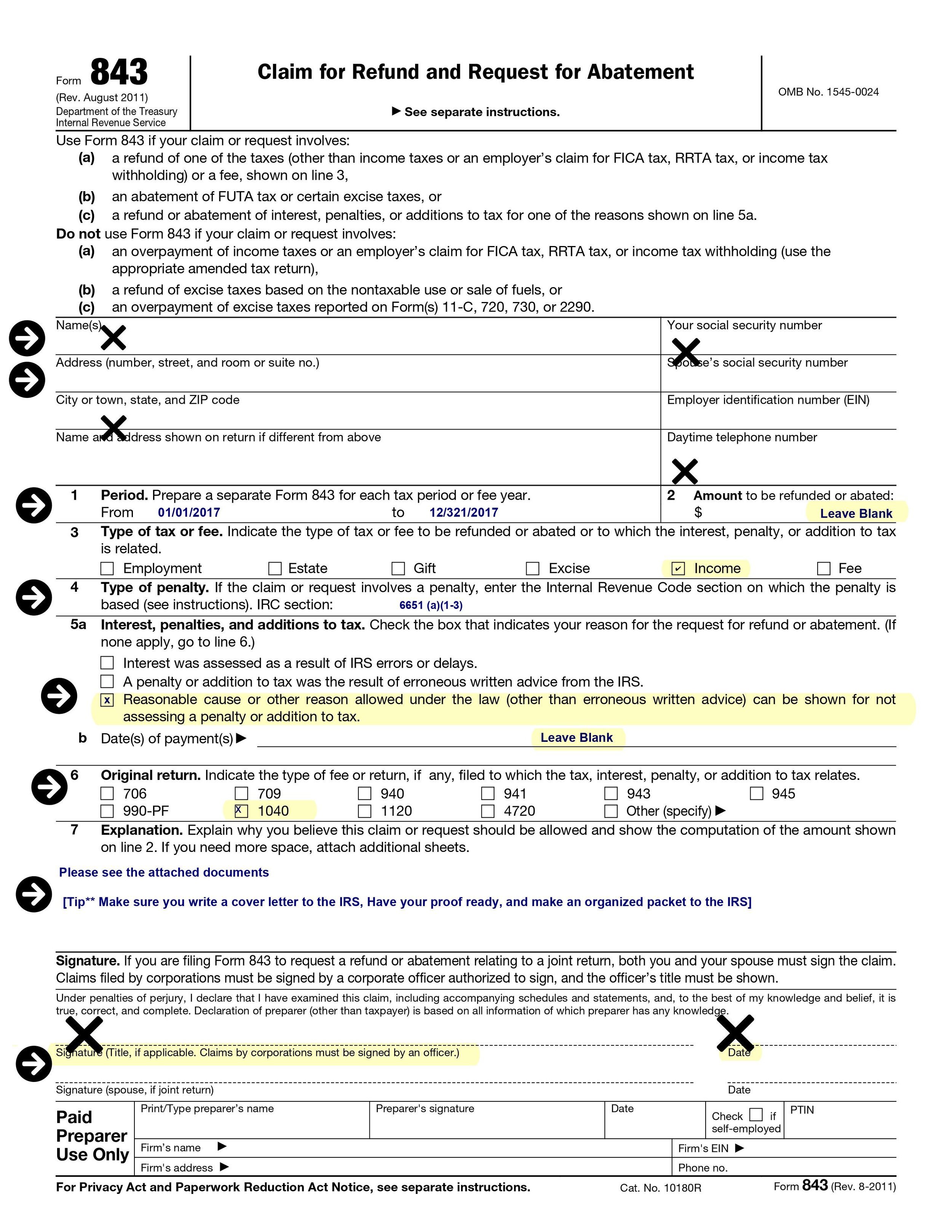

Source: www.sempertax.com

Source: www.sempertax.com

How to remove IRS tax penalties in 3 easy steps. — Get rid of tax, Doing so can reduce any fees and interest you'll pay on. The late filing penalty is 5% of your unpaid taxes for each month your.

Source: kerrfinancial.ca

Source: kerrfinancial.ca

Watch out! The CRA imposes a penalty for a repeated failure to report, To avoid a failure to file penalty, make sure you file your return by the due date (or extended due date) even if you can't pay the balance due. For returns required to be filed in 2024, the amount of the addition to tax under section 6651(a) for failure to file an income tax return within 60 days of the due.

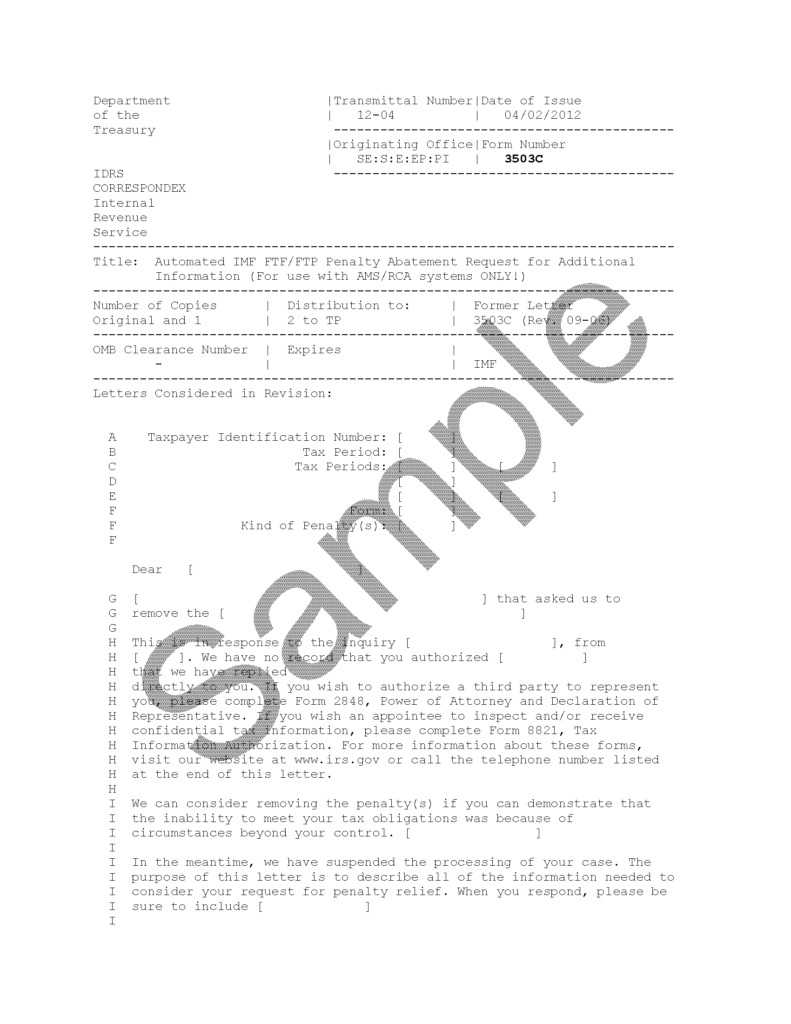

Source: www.hrblock.com

Source: www.hrblock.com

IRS Letter 3503C Failure to File/Failure to Pay Penalty Abatement, The penalty is calculated at 5% of the unpaid taxes for each month the return is late, up to a. To avoid a failure to file penalty, make sure you file your return by the due date (or extended due date) even if you can't pay the balance due.

Source: irssolution.com

Source: irssolution.com

Tax Return Failure To File RJS Law San Diego California, Late filing penalties apply if you owe taxes and don't file your return or extension by april 15, 2024, or if you filed an extension but failed to file your return by. For tax returns required to be filed in 2024, the minimum penalty for failure to file a return that is more than 60 days late has increased.

Failure To File A Tax Return.

The penalty on 2023 information returns required to be filed in 2024, and 2023 payee statements required to be furnished in 2024, that are corrected later than 30 days after.

Not Filing A Tax Return Is An Expensive Mistake.

That includes penalties for late returns and missed forms, as well as failure to provide forms to third parties.